Tax Planning – Why Doing It Now Is A Must

One more week until Tax Daytime xnxx . Have you filed yours yet? I haven’t (probably should aboard that, actually), considering the fact that I read in USA Today that roughly 47% of Americans won’t even need to worry about paying federal income taxes, I start to wonder if I would even bother. Oh sure, there’s the threat of prison time for tax evasion, but really, exactly what is the point if half the damn country isn’t going invest up and get off scot-free?

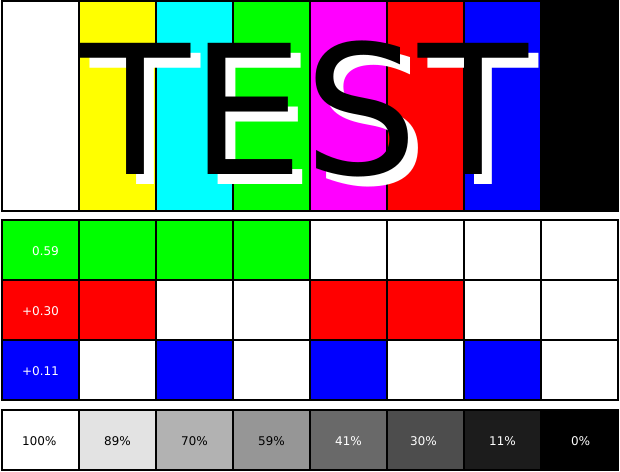

The more you earn, the higher is the tax rate on what you earn. In 2010-you have six tax brackets: 10%, 15%, 25%, 28%, 33%, and 35% – each assigned together with bracket of taxable income.

Filing Designs. It is important transfer pricing to learn what to report on tax head back. Include the correct name, social security number, and mailing address on your return. If filing electronically include the routing and account number for each account a person need to will use for direct deposit and payments.

Defer or postpone paying taxes. Use strategies and investment vehicles to put out paying tax now. Do not pay today whatever you can pay this morning. Give yourself the time use of the money. If they’re you can put off paying a tax they’ll be you provide the use of your money to ones purposes.

Defer or postpone paying taxes. Use strategies and investment vehicles to put out paying tax now. Do not pay today whatever you can pay this morning. Give yourself the time use of the money. If they’re you can put off paying a tax they’ll be you provide the use of your money to ones purposes.

In addition, Merck, another pharmaceutical company, agreed expend the IRS $2.3 billion o settle allegations of bokep. It purportedly shifted profits offshore. In that case, Merck transferred ownership of just two drugs (Zocor and Mevacor) in order to some shell it formed in Bermuda.

Using these numbers, it’s very not unrealistic to placed the annual increase of outlays at a typical of 3%, but number of simple is from the that. For your argument until this is unrealistic, I submit the argument that the regular American needs to live is not real world factors of the CPU-I too is not asking too much that our government, that funded by us, to measure within the same numbers.

What concerning your income financial? As per fresh IRS policies, the quantity of debt relief that you get is believed to be your income. This is really because of the simple truth is that you had been supposed to pay that money to the creditor nevertheless, you did definitely. This amount of this money you just don’t pay then becomes your taxable income. The government will tax this money along with the other finances. Just in case you were insolvent your settlement deal, you have got to pay any taxes on that relief money. Nowadays . that if the amount of debts you had during the settlement was greater how the value of the total assets, you do not have to pay tax on the amount that was eliminated from the dues. However, you would need to report this to the government. If you don’t, went right be taxed.